This is called 'premises liability.' If there was negligence on behalf of the store (such as failing to clean up spilled water), then it may be held accountable if someone suffers an injury due to their negligence.

Under Texas law, the simple fact that you slipped, fell, tripped, or otherwise got injured in a store or other business does not mean the business is automatically liable for your damages. You must prove that the business or premises owner did something wrong or was negligent.

When applied to the owner of a business, the question presented to the business owner is: "did the business owner use ordinary care in inspecting and keeping his premises safe from dangers that he knew of or in the exercise of ordinary care should have known of?"

Texas Courts have constructed this question into a two-prong test. The first question is "was there an unreasonably dangerous condition on the business premises?" Note that the law requires that the condition be unreasonably dangerous. If the condition is simply dangerous, then no matter what, the premises owner is not liable. The condition must pose an unreasonable risk or must be unreasonably dangerous to the ordinary consumer.

The second prong is that the store owner must know of the condition or have had the opportunity to inspect his premises and find the condition. This is probably the most important and most difficult part of establishing liability.

If you are walking down the aisle of a grocery store and slip in water or some other liquid and fall and injure yourself, that does not make the store owner liable. You have to prove that the liquid, or water that you slipped on, was on the floor long enough that the store owner should have had time to see it and clean it up.

They know they fell in a liquid, but they have no idea how long that liquid was there. They may say the liquid looked like it had been on the floor a long time, but the courts have held statements of the like to be insufficient evidence. You must have witnesses or another form of confirmation that the liquid was on the floor long enough that a careful business owner would have discovered the condition.

It is rare that you're going to find somebody who is in a store for 20-30 minutes or even an hour who can say that they came across a liquid while in the store and then came back an hour later when you fell, and the liquid was still there. Since the consumer cannot prove how long a liquid was on the floor, the store owner usually wins these claims.

Most stores have security cameras that are in the store 24 hours a day, 7 days a week, always watching the stores, the customers, and the floors. If there is a spill on the floor, the security cameras will catch it, and the video can tell the consumer and a jury how long the liquid was there and how long the store owner had to clean it up.

The lawyers of Stanley and Associates have fought to protect Texans and consumers from unsafe products, dangerous work conditions, unsafe job sites, and unreasonably dangerous premises.

If you, or someone you know have been seriously injured in a store, in an oil field accident, or in a construction accident - call Stanley and Associates. Call 844-227-9739 for more information.

If or when it is clear that the insurance company is unwilling to cooperate despite clear evidence of their insured's negligence, your attorney will file a lawsuit against the defendant.

It's very important to remember that your attorney would be suing the person that harmed you - not the insurance company. The insurance company will try to settle on behalf of their insured or they will hire lawyers to defend their insured in a lawsuit.

It's true! Even though it is fairly common knowledge that motorists are required to carry liability insurance, we are not allowed to mention it. This is so that the jury is not swayed into thinking the defendants can or cannot pay the potential amount the jury might award to the plaintiff.

This is a result of the power that the insurance lobby has over Texas law. That's a big win for the insurance companies but not always for the injured party. Insurance can prey on the sympathy the jury might feel for the defendant's ability or inability to pay for the plaintiff's damages.

On top of that, we have to pretend as if the defendant will be paying out of his or her own pocket for any potential verdict even though it is the insurance company who will pay.

It's important that passengers take the right steps after an accident to protect their potential claim. It may seem awkward to request insurance information if the at-fault driver is a friend, co-worker, or relative. However, that is exactly what liability insurance is for.

You may seem fine at first, but car wrecks often leave behind latent injuries that can take days, weeks, and in some cases, months to fully manifest. In fact, do not discuss your injuries with the insurance company at all.

Insurance companies are skilled in asking questions that have hidden legal implications in order to minimize your pain and suffering. Even everyday questions, such as "How are you?", can be used against you.

You should refrain from discussing your injuries until you have completed any treatment plans outlined by your doctor. It is best to consult with a personal injury attorney who can handle these conversations on your behalf and file a lawsuit to protect your rights.

You may have additional coverage on your own auto insurance policy, such as Personal Injury Protection (PIP) or Uninsured and Under Insured Motorist (UM/UIM), which can be critical if the at-fault driver does not have insurance or does not have enough insurance to cover your injuries.

Car accidents can be very disruptive to your everyday routine. Personal injury attorneys know the ins and outs of the entire process and can develop the best legal strategy for you to win your case.

Stanley and Associates are there for you through the entire process.

When you're already in pain, the last thing you want to deal with is phone calls, paperwork, and arguing with insurance companies. Our team will file all claims for you, handle all communications with the insurance companies, and we work with many physicians to ensure you get the treatment you need.

Best of all, you don't pay us a single dime until we win your case. If we don't win, you don't pay! If you're ready to make a decision, contact us as soon as possible. We are available 24/7 via email or phone call. Call 972-833-8000 today!

Once a police officer arrives, their job is to be a neutral third party and to document as much evidence as possible, including date, time, weather conditions, vehicle damages, injuries, identifying information for the individuals involved, witness statements, and video evidence (when available).

Based on the evidence collected, officers will typically assign contributing factors to determine who is at fault or majority at fault.

We have seen them all and they do occur more often than you may think. If the law enforcement officer got some objective information wrong, details about your vehicle, your insurance coverage, or the location of the accident, for example, you can probably get the report changed or amended as long as you provide documentation in support of the correction.

Critical errors, such as an officer attributing fault to you because of a misunderstanding, the officer siding with the other driver, assigning contributing factors to the wrong party or not obtaining a statement from an involved party, may require more effort on your part to have corrected, though, not impossible.

If you simply don't agree with something that is in the report, such as an account of the accident given by a witness, or the officer's finding that you violated a traffic law, you'll have a much tougher time getting any change made.

In that situation, the best you can probably do is write up your own version of the detail you are disputing and hope that it be included as a supplement to the report. In most cases, whether it is added to the report or not will be up to the law enforcement agency.

Once you have gathered your facts and details, it is time to contact the police officer or department to request the report be updated or changed. Remember:

If you find you are not getting anywhere with the police officer or department, it may be time to consult with an attorney regarding your personal injury case.

If you or a loved one have been injured in a car wreck due to a drunk driver, contact Stanley & Associates for your free case consultation. We have represented thousands of clients across Texas and have over a decade of experience.

Our Texas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, which means no fee unless we win. Call 844-227-9739

You may be entitled to compensation if you’ve been injured because of the negligent driving of an intoxicated driver. You have an additional right to sue any establishment that served the driver alcohol. This is a legal statute known as DRAM shop law.

It can be challenging to navigate the legal process alone, but with the help of a DWI accident attorney, you may be able to receive compensation for your injuries.

The legal process will begin by filing a personal injury claim against the intoxicated driver. You will need some documentation from your medical provider in order to document your damages. Your attorney can help you file this claim and will walk you through all the various forms needed for your case.

Under Texas law, a vendor of alcoholic beverages may be held liable for damages caused by an intoxicated person if the vendor served or provided alcohol to the individual when it was apparent that they were obviously intoxicated. The law applies not only to bars and restaurants but also to other vendors of alcohol, including liquor stores and convenience stores.

DRAM shop law does not relieve the intoxicated person of personal responsibility for their actions, nor does it excuse the victim's own negligence or fault in causing the injury or damages. The law does not apply if the individual who was served alcohol was a minor.

Due to the complex nature of car wrecks caused by drunk drivers, you should consult with a personal injury lawyer who can advise you on your legal rights and options under Texas law.

If you or a loved one have been injured in a car wreck due to a drunk driver, contact Stanley & Associates for your free case consultation. We have represented thousands of clients across Texas and have over a decade of experience.

Our Texas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, which means no fee unless we win. Call 844-227-9739

To obtain a rental, you will need to file a claim against the at-fault driver's insurance and check your insurance policy to see if you have rental coverage.

After an accident, insurance companies will conduct an investigation to determine who caused the accident. In the best-case scenario, the at-fault party's insurance company will accept liability right away and their insurance company will cover the cost of a rental vehicle.

More often than not, liability may be disputed. This means that one or both insurance companies need more evidence to determine who exactly caused the accident.

If this happens to you, you may need to use your own rental coverage on your policy to get into a rental car ASAP. If you don't have the coverage on your own policy or can't afford to pay for a rental out-of-pocket, you will have to wait until the at-fault party's insurance company accepts liability.

This also means that if you did not have rental assistance on your insurance policy and the other person was uninsured, you will be responsible for obtaining your own rental vehicle.

How long will I have a rental car after an accident? Read more.

Car accidents can be very disruptive to your everyday routine. Personal injury attorneys know the ins and outs of the entire process and can develop the best legal strategy for you to win your case.

Stanley and Associates are there for you through the entire process.

When you're already in pain, the last thing you want to deal with is phone calls, paperwork, and arguing with insurance companies. Our team will file all claims for you, handle all communications with the insurance companies, and we work with many physicians to ensure you get the treatment you need.

Best of all, you don't pay us a single dime until we win your case. If we don't win, you don't pay! If you're ready to make a decision, contact us as soon as possible. We are available 24/7 via email or phone call. Call 972-833-8000 today!

Never give a statement or sign anything without consulting with an attorney first. Even a greeting, such as "how are you doing today?", can be used to make it sound like you weren't hurt at all. In some cases, they'll try to place the blame on you!

Insurance adjusters are trained to use anything you say to diminish the value of your case. Attorneys are here to make sure that they don't. You should hire an injury attorney as soon as possible and refer all questions about your injuries to your attorney. #CallMyLawyer

Our attorneys know that insurance adjusters are not there to help you. They are there to protect the company and their own interests. They will try to get you to settle for less than what you deserve and they don't care if you get the medical treatment you need.

Car accidents can be very disruptive to your everyday routine. Personal injury attorneys know the ins and outs of the entire process and can develop the best legal strategy for you to win your case.

Stanley and Associates are there for you through the entire process.

When you're already in pain, the last thing you want to deal with is phone calls, paperwork, and arguing with insurance companies. Our team will file all claims for you, handle all communications with the insurance companies, and we work with many physicians to ensure you get the treatment you need.

Best of all, you don't pay us a single dime until we win your case. If we don't win, you don't pay! If you're ready to make a decision, contact us as soon as possible. We are available 24/7 via email or phone call. Call 972-833-8000 today!

In a jury trial, the defendant (at-fault, negligent party) always has insurance on their side.

The defendant's lawyers are provided by their insurance company to defend them from the lawsuit. However, during the trial - no one is allowed to even mention that insurance companies are involved. You can't even say the word "insurance" for fear of a mistrial.

This is one of the best kept secrets helping the insurance companies maintain their position as one of the most profitable industries in the world! Insurance companies are not keen to let this information out to their customers.

Even though liability insurance is a requirement in Texas, insurance companies don't want people to know that the defendants in a jury trial have liability coverage in case they are ever sued to avoid paying out big awards to the plaintiffs (injured victims).

They are preying on the sympathy of the jury - hoping they will assume the defendant can't possibly pay a big settlement on their own even though it is the insurance company who will pay.

Have a question of your own? Email us at info@seriousinjury.legal OR reach out to us on social media.

If you or a loved one have been injured in a car wreck due to a drunk driver, contact Stanley & Associates for your free case consultation. We have represented thousands of clients across Texas and have over a decade of experience.

Our Texas car accident attorneys are available 24/7 to assist you. We work on a contingency fee basis, which means no fee unless we win. Call 844-227-9739

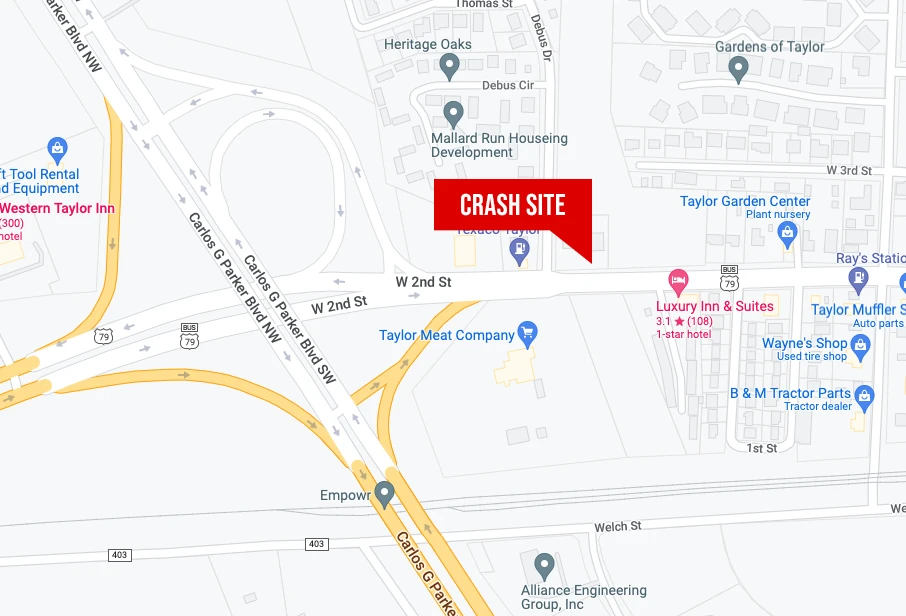

TAYLOR, Texas (KXAN) — Officers with the Taylor Police Department began an investigation Thursday after an overnight crash resulted in the death of a man near the 2000 block of West Second Street.

According to TPD, a caller reported the collision at 12:23 a.m. Thursday after a pickup truck hit a motorcycle.

TPD said 23-year-old Jesse Daniel Baldenegro, the driver of the motorcycle, was pronounced dead at the scene.

According to police, 27-year-old Guillermo Hernandez-Huerta was identified as the driver of the pickup truck. TPD said Hernandez-Huerta was exiting the parking lot of a hotel when the crash occurred.

Taylor Police said deputies with Williamson County reported seeing Baldenegro driving the motorcycle at a high rate of speed just before the collision.

According to a release, Hernandez-Huerta ran from the scene before officers arrived.

Later that morning, Williamson County deputies saw Hernandez-Huerta at a gas station, and they stayed with him until officers with TPD arrived.

According to the release, Taylor Police was in consultation with the Williamson County District Attorney’s Office regarding pending criminal charges.

TPD said this was the fourth fatal collision in Taylor for 2022.

Source: KXAN, NBC News

Corpus Christi, TX -- When officers arrived at the 7700 block of State Hwy. 358 at around 12:45 a.m., October 1, a Ram was on fire and the 28-year-old driver had just managed to get out of it.

The man was taken to a local hospital with serious, but non-life-threatening injuries.

The woman, who was driving a Honda CRV, died on impact in the head-on collision.

Police said their investigation determined the woman had been driving the wrong way in the left lane and they are unsure how she got onto the highway.

Source: 3News on KIIITV.com